It's economic theory: The more something is in demand, the more it costs.

When reviewing your commercial lease, what's the quickest way to find yourself on the wrong side of the negotiation table?

Leaving it too late....

"THE BEST WAY TO SUCCEED IS TO START EARLY WITH THE END IN MIND"

When entering the market for corporate real estate you can be forgiven for thinking it should be a simple enough process. With a good number of properties to view and lots of real estate agents to advise you on the way, how could you possibly get lost or pay over the odds for such a commodity?

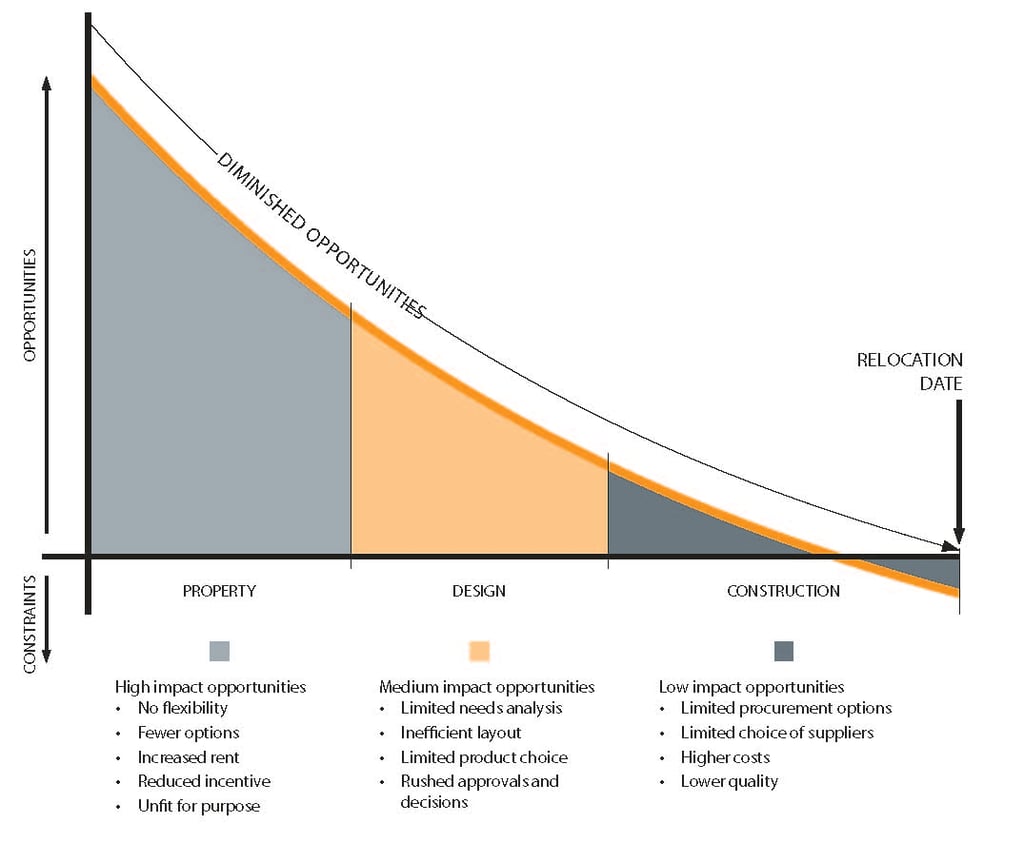

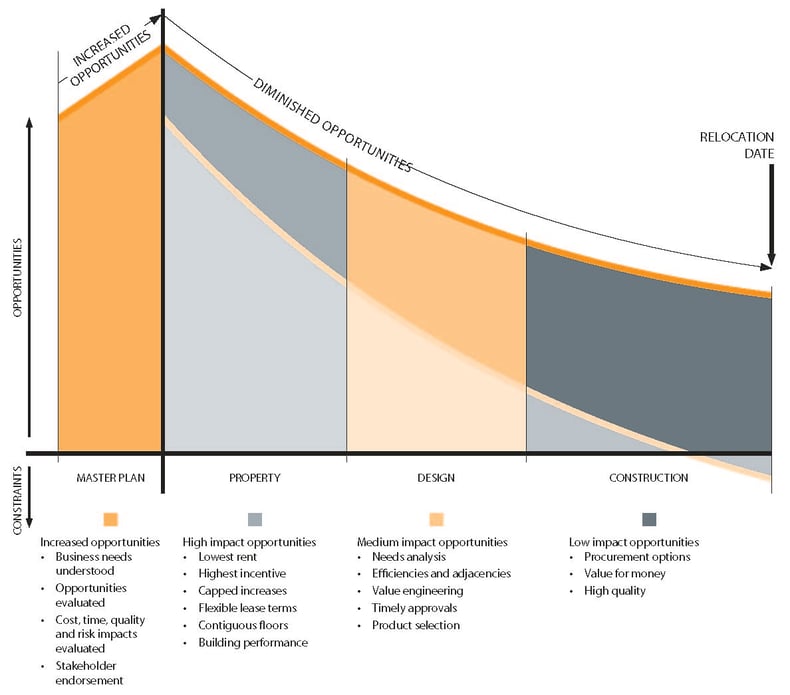

Many businesses set out to achieve a perfect fit workplace, but have a limited understanding of the time it takes to effect the right plan, the players who dominate the market and the way that time and cost conspire to limit the scope of the opportunity.

To avoid these risks, it is crucial to get a head start on how to manage the various players in the market. Failure to grasp the situation could mean a wasted opportunity at best and, in the worst case, a cost blowout of many millions of dollars.

TIMING YOUR MOVE

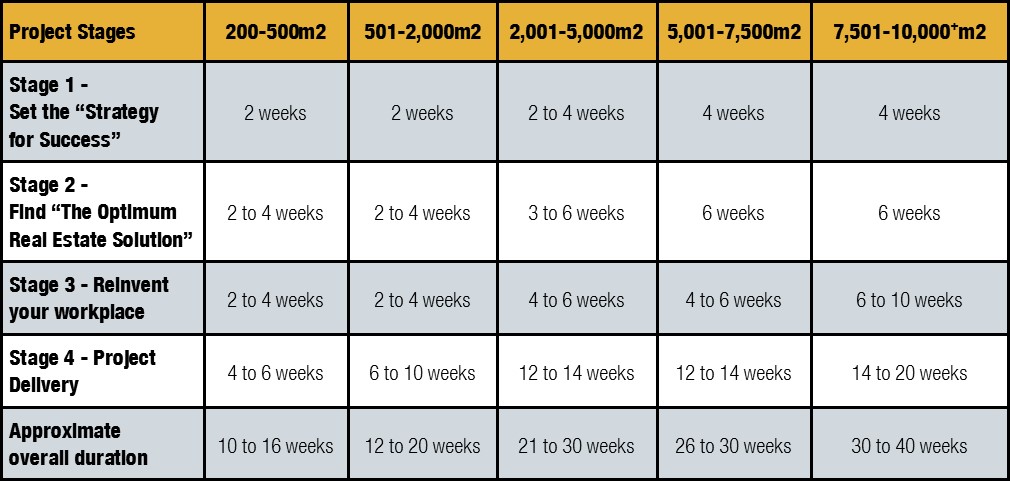

The amount of time that you allow to source and possibly construct your new workplace will depend on the size of your current office, the market conditions in your city, and the terms of the lease that you seek.

It is recommended that a business starts to consider their options and requirements at least 18 months prior to their lease expiry for any lease in excess of 1,000m2.

This will ensure plenty of time to go to the market and source appropriate property options, placing you in the strongest position to conduct negotiations. It will also allow you the necessary time for a fitout if required, ensuing you can make informed choices and limit costly, last minute decision making.

Excerpt from the PCG Guide: Relocating Your Business

Step 1: Set the "Strategy for Success" with a Master Plan

Planning is essential to ensure your strategy results in success. There is no better way to exert control over the process than via a Master Plan.

The Master Plan process is essentially due diligence for a longer term investment. Involving the input of all stakeholders, a business will assess corporate behaviours and work styles, environmental factors, market considerations, costs and procurement processes, creating a risk management and decision making tool which articulates the business case, setting out any criteria and strategy for workplace projects and corporate real estate initiatives. This will include resources and skills available required for workplace design and project management and construction. Enlightened property decisions should not be made in isolation of design and project management skills.

A Master Plan ensures that you go to market with a clear brief, understanding of accommodation needs and adequate time to avoid being dictated to. After all, when a tenant enters the market for a lease they are primarily looking for a workplace solution. The lease transaction whilst an important element is only part of this equation, however in far too many instances, it is the tail that wags the dog.

Without a Master Plan, businesses are skipping a vital step, quite often jumping straight into the property search phase, without being clear on business needs and therefore selection criteria. Consequently, the rest of the process can be dictated by the real estate deal and not by the needs of the business.

Step 2: Find the "Optimum Real Estate Solution"

Using the Master Plan as a brief, the business can now begin their property search and selection process.

Although an organisation may be clear that they are currently happy in their present location, it is important to "test the market" to create competitive tension. A landlord who believes their tenant is keen to stay will be less likely to be open to negotiation on terms. However, if the organisation is engaged with other landlords as they review options, the current landlord is likely be more generous in terms of incentives, discounts etc. It is not unusual for a business in a tenant market to discover they can find an upgraded office, in a better location for the same or similar to what they are currently expending on rent.

Throughout this period of time, suitable properties will be short-listed, inspected and then negotiations started with the top properties until a final winner comes out on top.

Step 3: Reinvent Your Workplace via Design

The essence of a great workplace comes down to design. Using a traditional property search process, the design commences upon securing a new lease. A Master Plan approach considers the future office design prior to property selection, determining strategic initiatives, desired behavioural changes, employee engagement and design elements which underpin a functional and inspiring workplace. These become objectives for the property selection process.

As a result of little or no pre-selection input from designers, a solution has to be "shoe-horned" into the chosen property. If the time allowed to design an efficient workplace is also further compressed by a rigid occupation date, the opportunity to create a functional and inspiring workplace becomes severely compromised.

In the worst case, major decisions and approvals are rushed, time to consider materials and products is inadequate, choices are limited and the value of any rent free period is eroded by construction and supply lead times.

As the Master Plan will have already touched on these points, any company that has included this step will already be poised to build the new workplace they have in mind, without the issues mentioned above.

Step 4: Project Delivery

Traditionally, by the time fitout construction commences, the project agenda is more likely to be about managing constraints rather than building for opportunities. Most tenants are jammed up against an optimal occupation date and at this late stage procurement options diminish, leading to limited consultant and contractor selection. This results in increased costs to procure and as timelines shorten, there is an increased cost to deliver. As costs escalate, quality is compromised.

With a strong Master Plan in place you arrive to the construction phase with plenty of time up your sleeve. Procurement options are available and costs are not incurred via the need for a "rush job".

Master Planning will allow the organisation to complete the workplace project in plenty of time for the business to move into their new location, without incurring penalty costs to have the office ready.

TRADITIONAL Vs. MASTER PLANNING APPROACH

The traditional approach of managing a commercial lease is a simplistic way of tackling the event. If you do not adopt the Master Plan philosophy, the business misses out on the opportunity of stakeholder engagement, identifying strategic opportunities for the business which they may be unaware of and the opportunity to develop the guiding metric for the time, cost and quality components of the project. This can result in extra costs, a substandard workplace or a race to completion in terms of construction.

Timeline of Traditional Approach to Property Selection

Comparatively, an organisation that values the Master Planning process discovers new pathways and opportunities because they were willing to explore new ways of decision making and/or workplace methodologies and design.

Timeline of Masterplanning Approach to Property Selection

HOW DO THE SAVINGS AND BENEFITS OF A MASTER PLANNED WORKPLACE STACK UP?

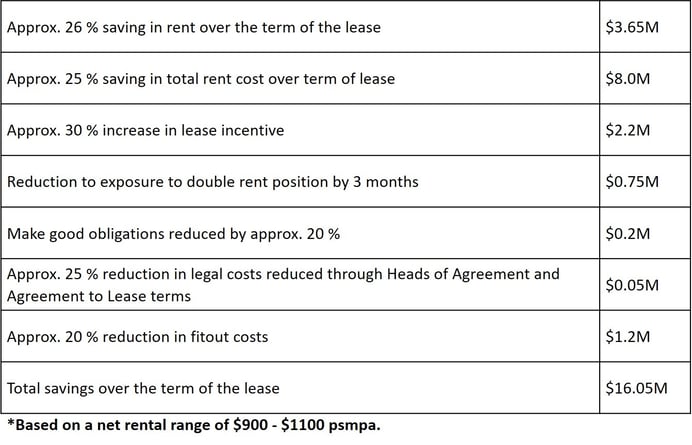

Following the Master Planning approach to Commercial Real Estate the following time, financial and risk mitigation benefits are realised:

- The duration of the property search and lease negotiation phases can be reduced by 50%

- Adequate time is allocated for design development, documentation and client approvals.

- The cost and time outcomes of the project can be guaranteed.

- A fitout of a higher quality can be delivered for the same cost.

HOW DOES THIS SHOW UP IN THE PROFIT & LOSS?

The following example is for a 10-year lease commitment within an A or premium grade property and a new fitout of 3000m2 in either Sydney, Melbourne or Brisbane:

For corporations that want to realise these potential savings on the Profit & Loss, the time to move is now.

Share your thoughts